Be Smart With Your Money

This is the easiest way I have found to ensure your expenses reflect your priorities. The breakdown is a simple one. 50% of your spending should go towards your needs, 30% goes towards wants and 20% goes towards your financial goals or priorities. Take a look at what falls under each category...

- Needs: These are going to be things like food, clothing and shelter. But there is more to it than that. You also have to have car insurance, utilities, and minimum debt payments so collectors don't come after you. Yes, minimum debt payments go here until the debt is repaid, additional debt payments as you start paying things off go under the savings category. When it comes to tracking your grocery bill, you more than likely won't know what that exact breakdown was last month for what was a "need" and what was a "want." Examples might include ingredients for a recipe as a "need" and chips or cookies as a "want." Event Orange Juice can be classified as a want. Get specific and aggressive here if you are looking to cut back on your overall spending. If this is the case, go back through your last month's expenses and roughly assign 80-90% of your overall grocery spending to "needs" and the remaining 10-20% as a want.

- Housing, utilities, car insurance, life insurance, phone plan, medications, and more.

- Wants: As you can probably guess these are all the optional things in life that provide your fun, entertainment or fulfillment. Try to be honest and aggressive with yourself when distinguishing between needs and wants in your spending. Again, depending on your financial health and current goals, "wants" are going to be the easiest changes you can make, the more you have, the more opportunity you have for improvement. A hard truth to face is where pets fall in this budget breakdown. For me, pets fall under a want. As much as I love my two dogs and as much as they are a part of the family the truth is they are a luxury or a form of entertainment I use to enrich my life. Therefore, their food, grooming, and any resulting vet bills are a "want" that I have intentionally placed in my life.

- Streaming services, dining out and fast food, movies, alcohol, UberEats, vacations, hotels, pet toys/food, vet bills, memberships.

- Savings: These are any and all financial goals and priorities that you have. This could be the $200/mo you are saving for vacation, or it could be the $400/mo you are contributing to your retirement account. If you are trying to payoff debt then it could be the extra $500 you paid towards that credit card. This is where all of your monthly saving, investing, or money action related moves are recorded. In short, this is the category that is moving you forward financially.

- College fund, debt payoff, retirement contribution, donating, investing, vacation fund, emergency fund.

How this Works

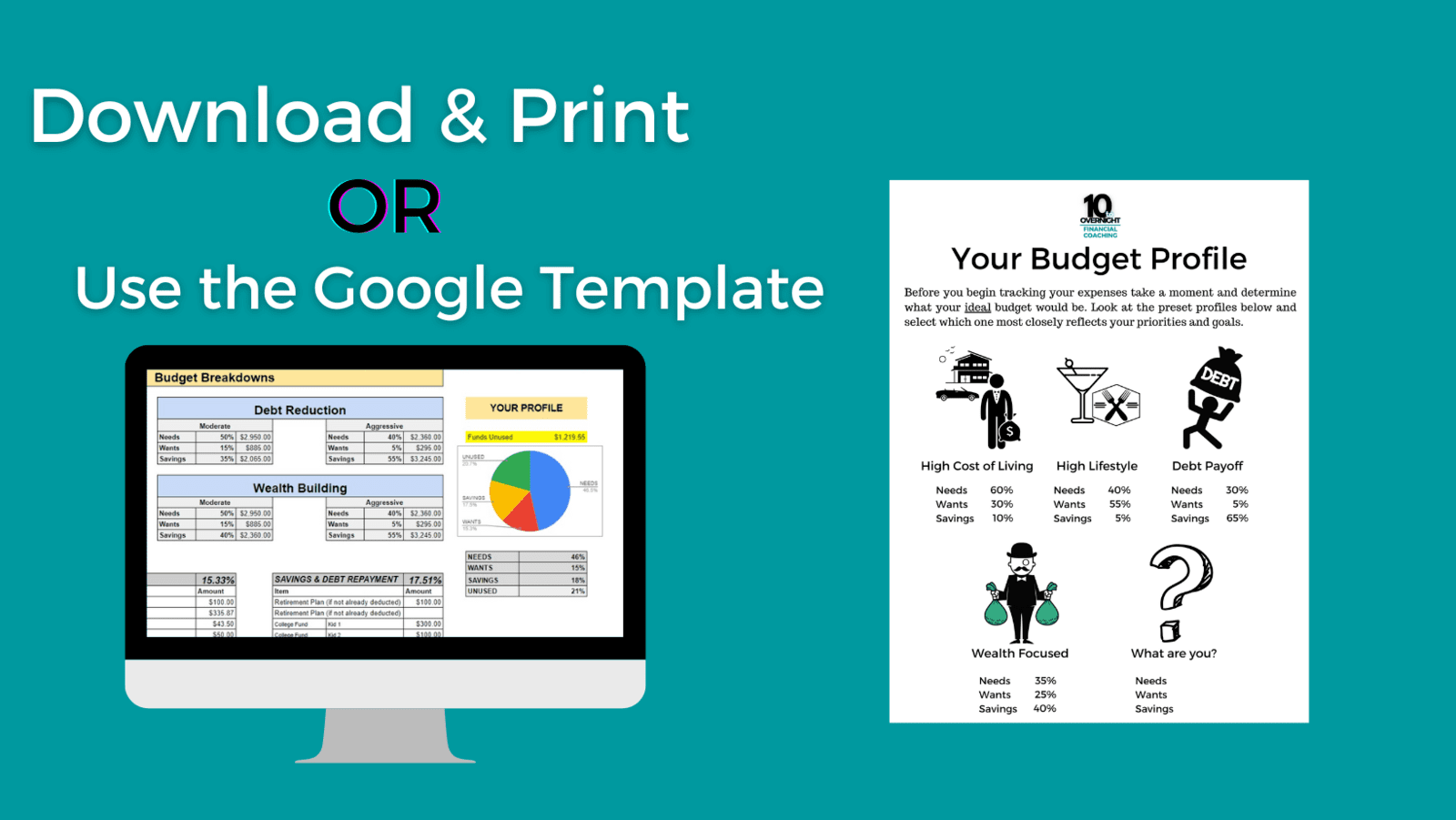

Before you start tracking where your money has been going I want you to first sit down by yourself or with your spouse and come up with two projections. The first is your ideal budget breakdown, and then where you think your spending actually has been (use last month's expenses).

- Ideal: Your ideal budget allocation should reflect how you see yourself. Who are the people and the spenders you want to be? You may tell yourself and others that you have certain goals or things you want to accomplish so in a perfect world, what would the budget breakdown for that person actually be? How would these numbers reflect those priorities? An example might be, for someone who is trying to get out of debt as fast as possible the budget might look like this (40-15-45) with a low cost of living (40%), few wants (15%) and the majority of their resources going towards paying down debt (45%).

- Reality: If you use a debit or credit card for the majority of your purchases you should be able to go to your bank's web site and print out you statement from last month or recent transactions. Go through it with 3 different highlighters and mark which ones fall into needs, wants, or savings. You can also plug into a free service like Mint.com and have all of your transactions labeled for you and then you can go in and refine those categories.